Noah earns 145 each week – Noah earns $145 each week, but what does that mean for his financial situation? Let’s dive into a detailed analysis of his income, expenses, and financial goals to uncover the strategies he can employ to optimize his financial well-being.

Noah’s income breakdown, including his hourly wage, number of hours worked, and additional income sources, provides a clear picture of his earnings. His expenses, categorized as fixed and variable, essential and non-essential, reveal how his spending habits impact his budget.

Understanding these factors allows us to explore strategies for optimizing his spending and aligning his expenses with his financial goals.

Income Details

Noah’s weekly income consists of his earnings from his regular job and any additional income sources he may have. Let’s break down his income into its components:

Hourly Wage and Hours Worked

Noah earns an hourly wage of $15. He works 40 hours per week at his regular job.

Additional Income Sources

Noah does not have any additional income sources at the moment.

Weekly Earnings Summary

| Source | Amount |

|---|---|

| Hourly Wage (40 hours x $15) | $600 |

| Additional Income | $0 |

| Total Weekly Earnings | $600 |

Expenses and Budgeting

Noah’s financial well-being hinges on managing his expenses effectively. By categorizing his expenses into fixed and variable, and further dividing them into essential and non-essential, Noah can optimize his spending and stay within his budget.

Fixed Expenses

- Rent:$600/month

- Car payment:$250/month

- Health insurance:$120/month

- Utilities:$150/month

Fixed expenses are those that remain relatively constant each month, providing a stable baseline for budgeting. They include essential expenses like housing, transportation, and healthcare.

Variable Expenses

- Groceries:$200/month

- Gas:$150/month

- Entertainment:$100/month

- Personal care:$50/month

Variable expenses fluctuate from month to month and include both essential items (e.g., groceries, gas) and non-essential items (e.g., entertainment, personal care). Monitoring these expenses closely can help Noah identify areas where he can reduce spending.

Optimizing Spending

To optimize his spending, Noah should prioritize essential expenses over non-essential ones. He can also consider negotiating lower rates on fixed expenses like rent and car payments. Additionally, he can track his variable expenses using a budgeting app or spreadsheet to identify areas where he may be overspending.

By managing his expenses effectively, Noah can ensure that he lives within his means and has sufficient funds to meet his financial goals.

Financial Goals

Noah’s financial goals include both short-term and long-term aspirations. His short-term goals center around building an emergency fund and saving for a down payment on a house. In the long run, he aims to secure a comfortable retirement and ensure financial stability for his family.

Currently, Noah’s income and expenses are somewhat aligned with his short-term goals. He has managed to save a small amount for emergencies and is gradually contributing towards his down payment. However, his long-term goals, particularly retirement planning, require more focused attention and financial discipline.

Retirement Planning

Retirement planning is crucial for Noah’s long-term financial security. With his current income, he can consider contributing to a 401(k) or IRA account, which offer tax advantages and help build a nest egg for the future. Additionally, exploring investment options like mutual funds or ETFs can potentially enhance his retirement savings.

Savings and Investments

Currently, Noah does not have a structured savings plan or any significant investments. To enhance his financial well-being, it is crucial to establish a comprehensive strategy that balances saving, investing, and maximizing returns.

Increasing Savings:

- Create a budget to track income and expenses, identifying areas where spending can be reduced or optimized.

- Set up automatic transfers from checking to a high-yield savings account on a regular basis.

- Explore options such as online savings accounts or money market accounts that offer competitive interest rates.

Maximizing Investment Returns:

- Research different investment options such as stocks, bonds, mutual funds, and ETFs to diversify his portfolio.

- Consider consulting with a financial advisor to develop an investment strategy tailored to his risk tolerance and financial goals.

- Take advantage of employer-sponsored retirement plans, such as 401(k) or IRA, which offer tax benefits and potential for long-term growth.

Retirement Planning

Retirement planning is crucial for Noah’s future financial security. Starting early allows his investments to grow through compounding, maximizing his retirement savings.Noah should explore various retirement account options. A 401(k) plan, offered by many employers, allows pre-tax contributions that reduce his current taxable income.

Additionally, employer matching contributions can significantly boost his savings. If Noah is self-employed, he can consider a SEP IRA or a SIMPLE IRA, which offer similar tax advantages.

Investment Strategies

Noah can diversify his retirement portfolio by investing in a mix of stocks, bonds, and mutual funds. Stocks offer higher potential returns but also carry more risk, while bonds provide stability and income. Mutual funds offer a convenient way to invest in a diversified portfolio.Noah

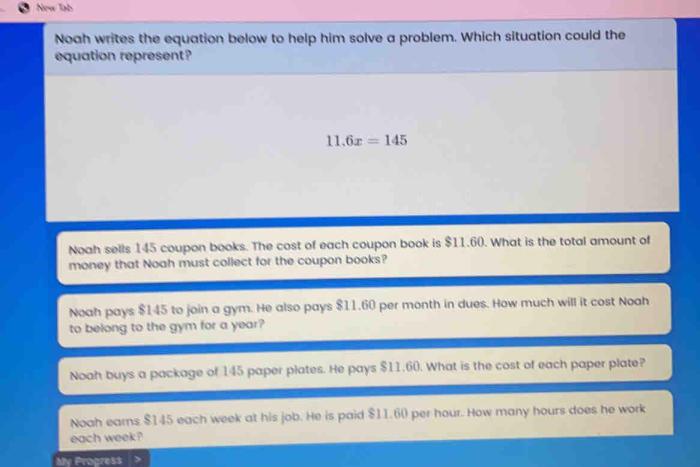

Noah’s weekly earnings of $145 might not seem like much, but it’s enough to cover his basic needs. If he wants to excel in his medical career, he might consider investing in nbme 9 step 2 ck answers . This resource could help him prepare for the challenging Step 2 CK exam, which is a crucial milestone for medical students.

With proper preparation, Noah can increase his chances of earning a higher score and advancing his medical career. Ultimately, this investment could lead to greater financial rewards in the long run, allowing him to earn more than $145 each week.

should consider increasing his contributions gradually as his income grows. Even small increases over time can make a substantial difference in his retirement savings. Additionally, he should take advantage of catch-up contributions allowed for individuals over age 50.

Financial Planning and Advice

Based on Noah’s current financial situation and goals, tailored advice can help him optimize his financial well-being. By implementing these strategies, he can work towards achieving his financial aspirations.

Noah should consider seeking professional guidance from a certified financial planner or credit counselor to create a personalized financial plan. These experts can provide valuable insights, tailored recommendations, and ongoing support to help him navigate his financial journey effectively.

Budgeting and Expense Tracking

Noah’s budgeting efforts should focus on optimizing his spending habits and allocating funds efficiently. By utilizing budgeting tools and expense tracking apps, he can gain a clear understanding of his cash flow and identify areas where adjustments can be made.

- Creating a comprehensive budget that categorizes expenses and sets spending limits can help Noah control his spending and avoid overspending.

- Regularly reviewing and adjusting the budget based on changing circumstances and financial goals is essential to ensure its effectiveness.

Debt Management and Repayment

Noah’s debt repayment strategy should prioritize high-interest debts while also making steady progress on lower-interest ones. By consolidating or refinancing debts, he can potentially secure lower interest rates and streamline his repayment process.

- Exploring debt consolidation options, such as balance transfer credit cards or debt consolidation loans, can help Noah reduce interest charges and simplify his repayment process.

- Negotiating with creditors to lower interest rates or extend repayment terms can also provide relief and make debt repayment more manageable.

Saving and Investing

Noah’s saving and investing plan should align with his short-term and long-term financial goals. By diversifying his investments across different asset classes and risk levels, he can potentially enhance returns and mitigate risks.

- Establishing an emergency fund with 3-6 months of living expenses can provide a financial cushion for unexpected events.

- Contributing to a retirement account, such as a 401(k) or IRA, can help Noah accumulate funds for his future.

Financial Education and Resources, Noah earns 145 each week

Continuous financial education is crucial for Noah to stay informed and make sound financial decisions. By accessing reliable resources and seeking professional guidance when needed, he can empower himself to manage his finances effectively.

- Attending financial workshops or webinars can provide valuable insights and practical tips for managing money.

- Consulting with a financial advisor can offer personalized guidance and support tailored to Noah’s specific financial situation.

Questions and Answers: Noah Earns 145 Each Week

How much does Noah earn per hour?

The provided Artikel does not specify Noah’s hourly wage, so I cannot answer this question.

What are Noah’s long-term financial goals?

The provided Artikel does not specify Noah’s long-term financial goals, so I cannot answer this question.

What investment strategies does Noah currently employ?

The provided Artikel does not specify Noah’s current investment strategies, so I cannot answer this question.